You would have seen many examples of an irregular correction during uptrends. But can we get an irregular correction in a down trend? This article explains that it is indeed possible to see that complex correction in a down trend and we use an example from the EURO to illustrate it.

What is the most common place for an irregular correction to occur?

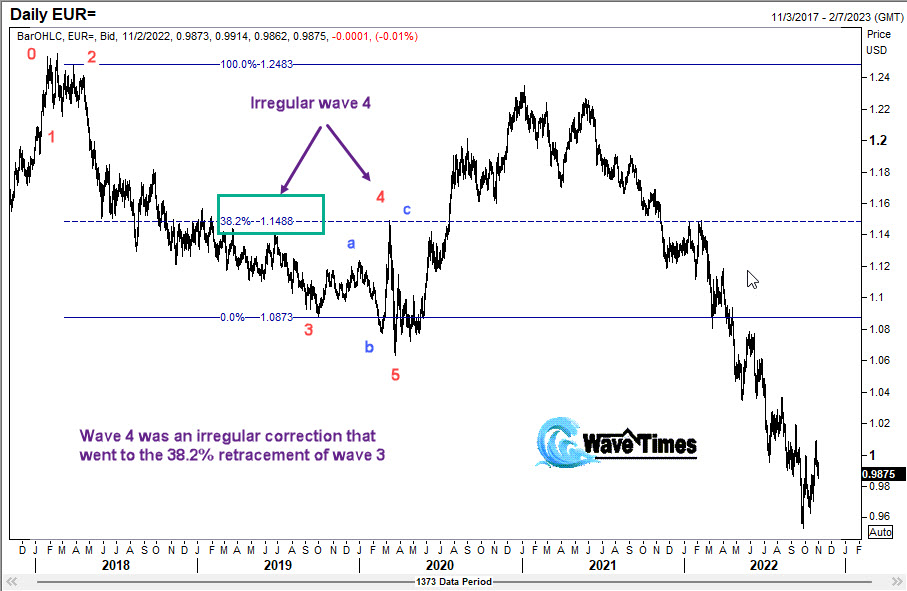

The most common place for an irregular correction to occur is during a wave 4. But as you know, we can see a fourth wave in both up trends and down trends. During a zig zag correction, wave A is made up of five sub waves. The fourth sub wave is often a good candidate for an irregular correction. Sometimes, we can see the irregular correction during the sub wave 4 of wave C in a zigzag correction.

What is the most significant clue that an irregular correction is developing?

When a wave 3 is finished, we will look for a correction. Let us say this correction develops in 3 waves. But these three waves together appear to inadequately correct wave 3. In this scenario there is a very high chance to see an irregular correction. The inability of these initial set of three waves to adequately develop means the selling pressure in a downtrend is still overwhelming. Often, we will get a push lower to new lows below the wave 3 bottom. This new low will be the irregular B wave. The subsequent recovery will be wave C in 5 sub waves, and we often reach the retracement target at that time.

Example of an irregular correction in a down trend.

In the chart below, you can see the Euro is in a down trend. Observe that once wave 3 was finished, we got a small set of three-waves up. Together, these three waves did not adequately correct wave 3. That produced an irregular wave B that went below the bottom of wave 3. We then got a surge as wave C of the fourth wave. Together, these constitute an irregular correction that happened in wave 4 of the down trend. You can see that wave 4 managed to reach the 38.2% retracement of wave 3.

Conclusion

We can see the occurrence of an irregular correction in a down trend just as often as we see them in an uptrend. The clues to identify them as they develop is an inadequate development of the first set of three waves. We will also often see the wave C of the irregular correction make a surge to take the price to a more acceptable retracement level of the prior impulse wave. These have all been illustrated above with the help of a chart of the Euro.

My online course on how to profit from Elliott Waves describes these complex patterns with high definition videos. If you liked my book Five Waves to FInancial Freedom, you will love this course too.