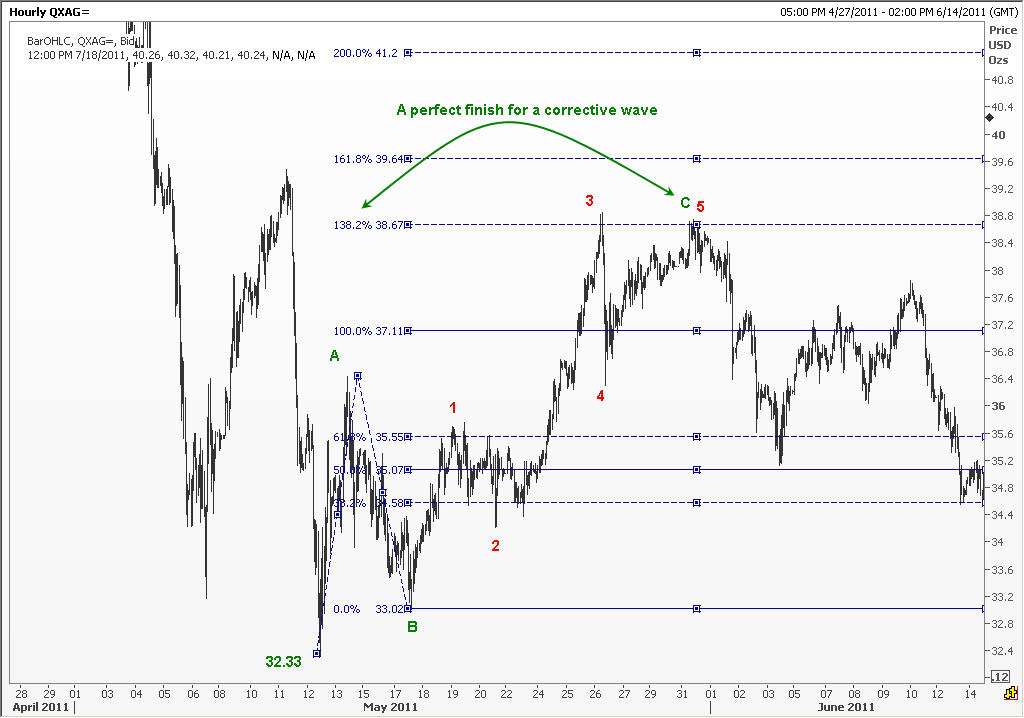

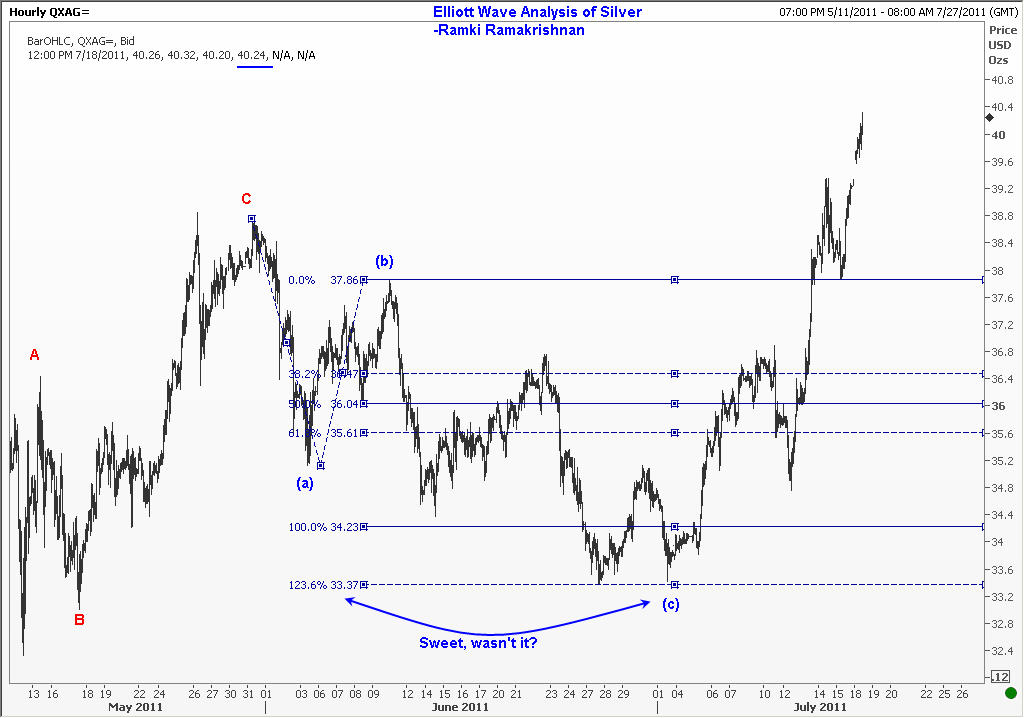

Elliott Wave Analysis of Silver

A picture is worth a thousand words, they say. Here I am giving you four pictures of Silver, and the lesson you learn from them is worth quite a bit. Enjoy, and share.

Elliott Wave Analysis of Silver, presented by Ramki Ramakrishnan

12 Responses

-

zen | July 18, 2011 at 8:17 am

Hi. Do you see this as the beginning of a motive phase, or could the next leg down bring prices even lower than the lows in May? Thanks!

0

-

Giriraj Sharma | July 18, 2011 at 4:56 pm

Can you give subdivision of 3rd wave in progress?

0

-

mannish garg | July 19, 2011 at 8:03 am

Dear Ramki Sir:

I am a avid follower of your blog. I have to congratulate you on your precise calculations and observations of Elliott Wave. I know these tools you have acquired from experience and that too over time, one cannot have them overnite. I have asked you in the past, and also a lot of your readers too, and you have answered too. The question is :

Is there a path one can follow to decipher Elliott Wave. Also you have mentioned in your posts that the best way to start is to read “Frost Perchers The Elliott Wave Principle”. Do you suggest any other book apart from this and also, your charts look way too easy to make, but unfortunately majority of traders like us do not have access to Thompson Rueters charting software, hence can you suggest any other that one might be able to use for the wave purpose.

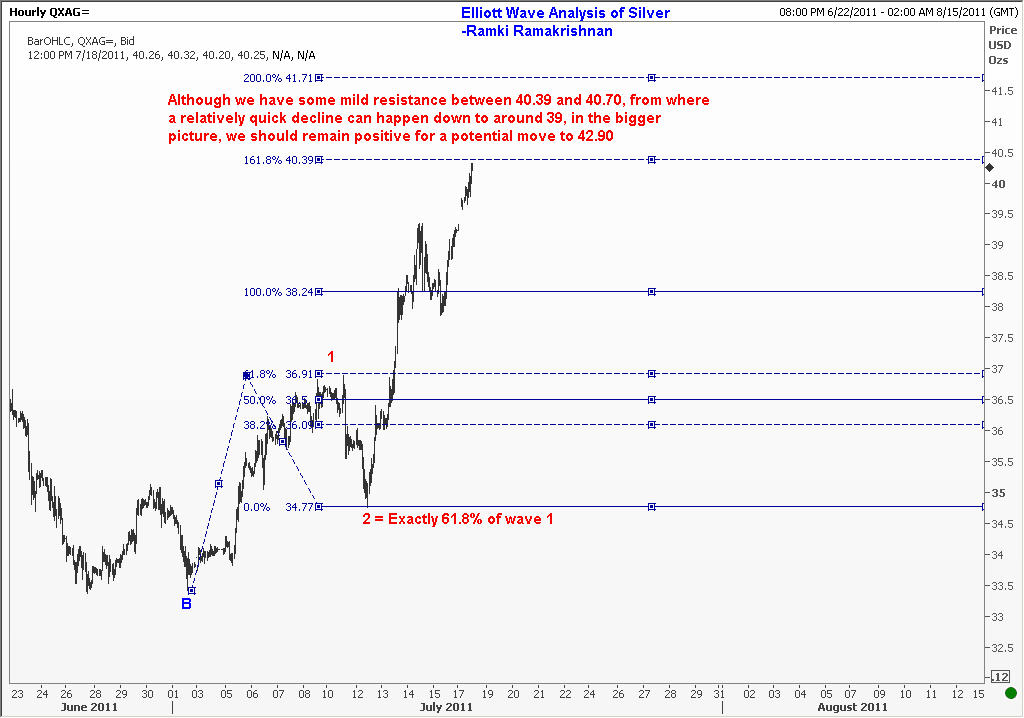

BTW, why i posted in Silver, because ONCE AGAIN you are correct and silver is retracing to 39 USD and we did find sellers at USD 40.85 as you predicted.

Would love to meet you in person if you are in India.

Best Regards Sir, and happy waving

0

-

Ramki | Authour | July 19, 2011 at 10:42 pm

Mannish, Thank you. You don't need to have any fancy software to do Elliott Wave Analysis. The tools I use only saves me time. They don't give me any additional advantage in terms of interpretation of the waves. It would be my pleasure to meet with friends when I visit India next.

0

-

-

chauhan mufazal | July 28, 2011 at 5:13 am

hi sir thanku you very much for silver updete,i am new to this derivatives trading, i learn a lot of from your web update, and this is quite intresting,i normaly use fibo. levels only, thanks looking for silver and nse india update

0

-

Manoj | July 29, 2011 at 11:19 pm

Sir As Per Ur Expectations Silver Went Upto 42$— Whts Ur Next View IN Gold Silvver–Is The Bull RUN Over!! or Sttill Some Steam Left

Regards

Manoj0

-

manish garg | August 4, 2011 at 11:17 am

Sir:

Can you PLEASE share / update your view on silver / gold / crude and may be dow jones (DJIA) in wake of the melt down.Thanks

Manish0

-

Yash | August 20, 2011 at 12:54 pm

Sir,

It was pleasure going through your elliott analysis and extremely knowledgeable to new ones like me who are eager to learn about the famous elliott wave analysis.As per above charts Silver started its melt down from $49.5 odd levels and stopped its fall around $32.2 levels. If we take this fall as an WAVE A then WAVE B can be retraced up to $42.93 levels and as on today 20/08/2011 its almost close to it.

If this study is right then wave C can be more dangerous fall which is targeting for $25.7 levels.

Kindly justify can it happen, if yes then will Gold support the fall or it will be bullish.

Please do reply.

Thanks & Regards.

0

-

Chauhan mufazal | August 20, 2011 at 6:34 pm

Hi sir u make my life in trading.,waiting for your book! In silwer we are in 3rd wave,have a look if time permits in book Plese include supportiv effctive tools like ema,macd.rsi etc if u think that are usefull thanks

0

-

zen | August 23, 2011 at 12:49 pm

Silver fell today from a high of $44.28 to the mid $41 range. Could this be minor wave 1 of wave 3? Will be looking for minor wave 2 up to develop soon. A tentative position in ZSL could be entered here with a stop at what corresponds to $44.28 spot.

0

-

John | August 27, 2011 at 4:58 pm

I just wanted to thank you for sharing your work. You are the best Elliott wave chartist I have seen. I had given up on EW, especially after subscribing to EW international years ago, both the commodities and the indexes. Your labeling is so clean, makes it seem obvious (which it certainly isn't). Thanks for mentoring us. I look forward to your book and also your updates.

0

Recent Posts

Recent Comments

No comments to show.

Manoj | July 18, 2011 at 5:49 am

Sir Do U Think Will Silver Cross Its Lifetime High This In MCX–Or Comex Before Givng A Wild Correction..

0