The year was 1976, and I had just turned 18. The results of my pre-university program had just come in, and I had scored over 90%, ensuring my admission to the highly respected College of Engineering in Guindy. Alas, that was not to be. Family circumstances compelled me to give up my dreams and take up the job of a lowly clerk at a Government-owned bank. On the first day at work, as tradition warranted, I suppose, they sent me to work in the mail room! On that day, I resolved that this should not be my destiny.

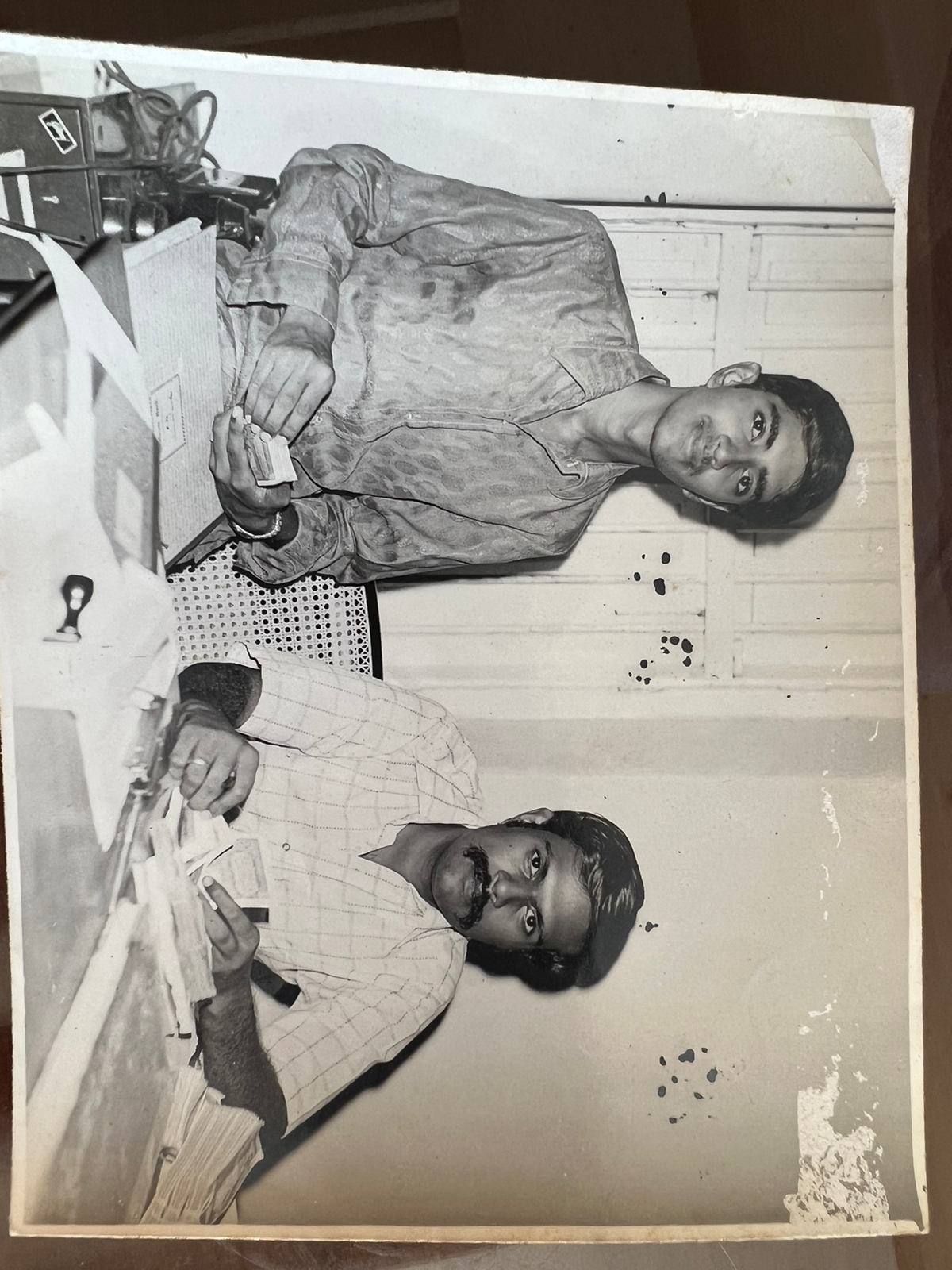

Ramki (on the left) counting cash at the bank

Only a few weeks back, I had been reading about Wall Street and the powerful foreign exchange traders who moved money by the millions every day. That is where I belonged, I thought. But how can a mere boy who barely finished high school and works from 8:30 a.m. to 5:30 p.m. (two shifts) hope to accomplish this? Call it providence, or whatever you will, but I got lucky and achieved this dream. It was not easy, though! But I will save the story for another day.

Below are some Xerox copies of Reuters Dealing System conversations that evidence the fact that Foreign Exchange Dealers from every corner of the world were calling me for my views on the market. This happened as early as 1989, a mere 13 years from that fateful day. In the interim, I graduated with a degree in Economics, a Masters in English Literature, a post-graduate qualification in Marketing Management with a university rank, professional banking qualifications from the Indian Institute of Bankers, professional qualification in International Banking from the Chartered Institute of Bankers, London (securing the first rank from among world-wide candidates) and professional qualifications in Treasury Management from the Association of Corporate Treasurers. I also won the Lombard Association Prize for Finance of International Trade.