In this post, we are going to discuss the New Zealand Dollar Outlook. As always, we will use the Elliott Wave Analysis to form our conclusions.

Where do we start our analysis?

We start our analysis from the most recent significant low for the New Zealand Dollar. This has been explained in detail in my Elliott Wave book “Five Waves to FInancial Freedom“.

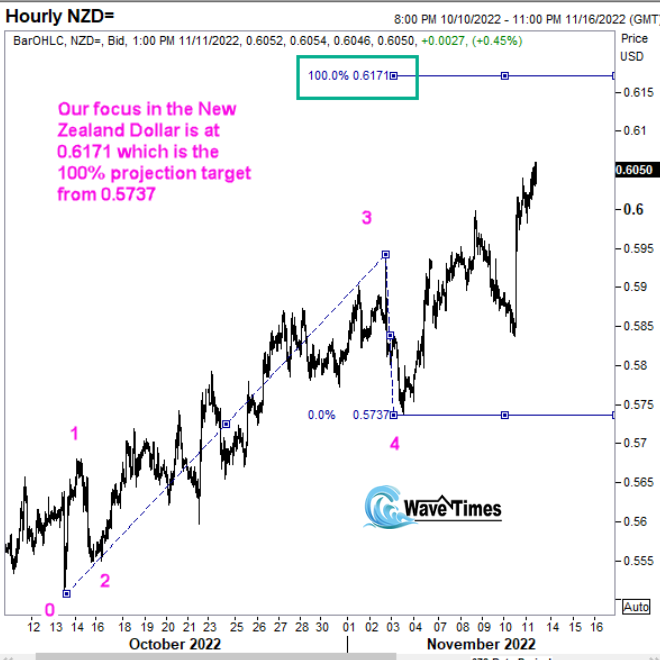

We see from the above chart that we place the first Elliott Wave label at the lowest significant low. That point is called the zero point. We then proceed to place the labels for wave 1 and wave 2. The end of wave 3 for the New Zealand Dollar is also shown. The more interesting thing is we have projected a 100% measure of the distance from point zero to point 3. That target is at 0.6171. Our analysis thus has the outlook that 0.6171 is a possible target for the New Zealand dollar in the near term.

How do we gain confidence in our outlook for New Zealand Dollar?

We gain confidence in our outlook for the New Zealand Dollar by approaching the analysis from a different angle. Let us draw the Fibonacci Retracement of the move from 0.7218 to 0.5510. We see that a 38.2% retracement level comes at 0.6162. This is very close to the 0.6171 level we got in the previous chart. Such a confluence of Fibonacci levels adds to our confidence that our outlook for the New Zealand dollar could well be right.

Conclusion

We conlcude that in the near term, the outlook for the New Zealand DOllar is for it to find reistance around the 0.6162 levels. We may or maynot reach that level. But if it does get there, we could well have a trading opportunity. My online Elliott Wave Course, How to Profit from Elliott Waves, explains in detail what are the various factors we should take into account before entering a trade.